Throughout history and under all skies, politicians positioned by electoral circumstances in opposition must erase the memory of what they could or should have done when they were in power, and thus criticize their adversaries who are temporarily in power without respite. This is the political logic that everyone applies alternately.

We can count on the unwavering tenacity of Christian Estrosi to accomplish this task without missing the slightest opportunity, especially since the theme of high taxes is one of his favorites.

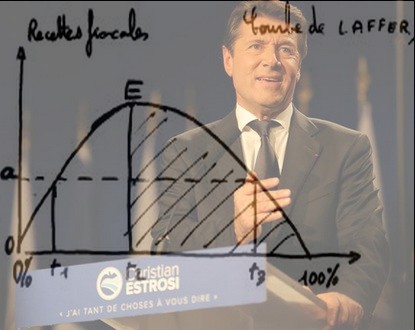

However, the theoretical reference that the mayor of Nice often appeals to requires some clarification. In fact, the Laffer Curve has never gone beyond the stage of a “nice to hear” idea (as Anglophones say) without ever achieving the academic prestige it lacks.

While no one denies that a 100% tax rate would reduce state revenues to almost nothing, the development of the relationship around the optimal tax rate remains contested.

Critical economists, like Nobel Prize winner Joseph E. Stiglitz (whom President Sarkozy appointed in 2008 as head of the commission on the measurement of economic performance and social progress), accuse Laffer of presenting a curve whose shape is actually unknown, without specific empirical studies to determine its notable points and particularly that of the optimal tax rate.

In fact, despite its appeal (paying the least tax possible is every taxpayer’s dream), the Laffer Curve lacks a theoretical framework to structure successful and tangible applications!

Except perhaps one, in 1981, when Ronald Reagan’s advisor, Laffer, prompted him to significantly reduce mandatory levies. However, the result was disappointing: the announced tax revenues did not materialize, and the deficit exploded.

George Bush (senior), who succeeded Reagan, put an end to its application and even called it “voodoo” economics. In fact, the only noticeable effect was a significant reduction in taxes for the most privileged categories. Some blame it for having caused the rise of social inequalities.

The mayor of Nice in his anti-government crusade should consider this: A few slogans (one could add in the same vein: “high rates kill totals”) satisfy his supporters but do they go beyond that?

And to be even more precise, it didn’t take Arthur Laffer to advance the principle that “it is better for many to pay little than for few to pay a lot,” to minimally simplify the basic idea of the American.

One could recall that, as early as the 14th century, the Muslim philosopher Ibn Khaldun wrote in his book “Al Muqaddimah”: “It is our duty to say that at the beginning of the dynasty, taxes were rich with small impositions whereas at the end of the dynasty, taxes were poor despite high impositions.”

All experts agree that a fiscal policy must meet three criteria: equitable, easy to understand, and generating maximum revenue. Unfortunately, no one has yet found the magic formula to apply it.

Perhaps one day the Holy Spirit will come to our aid, but until then, it would be good to put the Laffer Curve back in mothballs.